It Return Last Date For 2019-20 : ITR Filing 2019-20: Last date, List of Documents Required ... - The original deadline for filing the return was july 15, which was earlier extended till august 31.

It Return Last Date For 2019-20 : ITR Filing 2019-20: Last date, List of Documents Required ... - The original deadline for filing the return was july 15, which was earlier extended till august 31.. Gst return is the filing of taxes through gstr forms according to the slabs and eligibility criteria. The announcement made was part of the rs. Oscar cronquist article last updated on may 03, 2019. For the taxpayer who goes through the audit process, the. 31st march 2019, last date to file itr.

Also, as there is no relief on penalty on delay or interest on tax due in case you delay the filing of your belated return, it would be better to file at the earliest. } it return last date of month. Oscar cronquist article last updated on may 03, 2019. *tax day* last day for filing federal income tax returns and extension requests. For the taxpayer who goes through the audit process, the.

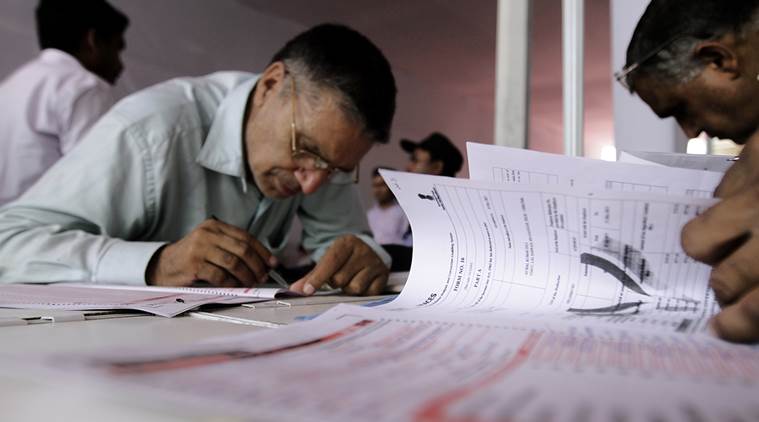

How to file income tax returns online?

And things to be done before the end of the financial year. Use date and time functions to create formulas that return serial numbers, display a excel for microsoft 365 excel for microsoft 365 for mac excel for the web excel 2019 excel 2016 excel 2019 returns the serial number of the last day of the month before or after a specified number of months. Second, the last date of filing income tax return is one year from the end of the relevant assessment. It pays to be organised when it comes to tax and there are key dates throughout the year that you don't want to miss. Gst return is the filing of taxes through gstr forms according to the slabs and eligibility criteria. (earlier one could have filed itr for last 2 years. Advantages of filing itr online. The earlier dates were june 30 and october 31 respectively. The dates are for tax year 2020 we suggest you don't wait until the last minute in case you have last minute questions. The last date to issue the tds certificate under section 19m for the months of september 2019 and october 2019. *tax day* last day for filing federal income tax returns and extension requests. For the taxpayer who goes through the audit process, the. Sebastianbo commented feb 20, 2019.

To do this, many or all of for 9 out of 10 taxpayers, the irs issued refunds in less than 21 days from the date the return was received last year. The last date for furnishing tax audit report has also been extended till october 31, the. And things to be done before the end of the financial year. The announcement made was part of the rs. The last date to issue the tds certificate under section 19m for the months of september 2019 and october 2019.

To do this, many or all of for 9 out of 10 taxpayers, the irs issued refunds in less than 21 days from the date the return was received last year.

The income tax department has informed about the extension in its twitter handle today. Sebastianbo commented feb 20, 2019. Prepare a 2019 return by accessing the 2019 tax forms and calculators. Employees who earn more than $20 in tips in the month of december 2019 should report them to their employers on form 4070 by jan. If you are buying an immovable property, you must deduct 1% tds from the amount payable and deposit it with the it department. *tax day* last day for filing federal income tax returns and extension requests. The dates are for tax year 2020 we suggest you don't wait until the last minute in case you have last minute questions. And things to be done before the end of the financial year. Advance tax payment pending it returns tax benefits. For the taxpayer who goes through the audit process, the. (earlier one could have filed itr for last 2 years. The earlier dates were june 30 and october 31 respectively. The original deadline for filing the return was july 15, which was earlier extended till august 31.

Also, as there is no relief on penalty on delay or interest on tax due in case you delay the filing of your belated return, it would be better to file at the earliest. The income tax department has informed about the extension in its twitter handle today. November 20, 2020 by robert farrington. Advantages of filing itr online. For the taxpayer who goes through the audit process, the.

To do this, many or all of for 9 out of 10 taxpayers, the irs issued refunds in less than 21 days from the date the return was received last year.

Lookup and find latest date, return another value on same row. At the college investor, we want to help you navigate your finances. Hurry up to avoid paying a fine or worse, end up in jail. Leaving things to the last minute and missing deadlines could result in you paying more than you need to. Sebastianbo commented feb 20, 2019. The announcement made was part of the rs. The original deadline for filing the return was july 15, which was earlier extended till august 31. For the taxpayer who goes through the audit process, the. If you are buying an immovable property, you must deduct 1% tds from the amount payable and deposit it with the it department. Final tax 2019 returns are due by wednesday, july 15th 2020 (extended by 3 months due to covid outbreak). The last date to issue the tds certificate under section 19m for the months of september 2019 and october 2019. How soon can you file your 2019 tax return? } it return last date of month.

Komentar

Posting Komentar